How Digital Bill Payments Are Simplifying Household Finances

In recent years, the transition towards digitalisation has transformed numerous aspects of our daily lives. One such significant change is how we manage our household finances through digital bill payments. This shift is not merely a technological advancement but a powerful tool facilitating ease, efficiency, and security. Let’s delve into how digital bill payments are reshaping household finances, offering both convenience and control.

The Rise of Digital Bill Payments

Traditionally, managing household bills involved a substantial amount of paperwork and manual handling. Travelling to payment centres, waiting in long queues, and keeping track of numerous receipts were common challenges. However, the advent of digital solutions has simplified this process dramatically.

Digital bill payments have grown exponentially, largely due to the increasing penetration of smartphones and internet connectivity. According to a study by the Reserve Bank of India, digital transactions in the country have witnessed a growth rate of over 50% annually. This trend indicates a significant shift towards cashless payments, driven by the need for more efficient financial management.

Ease of Use and Accessibility

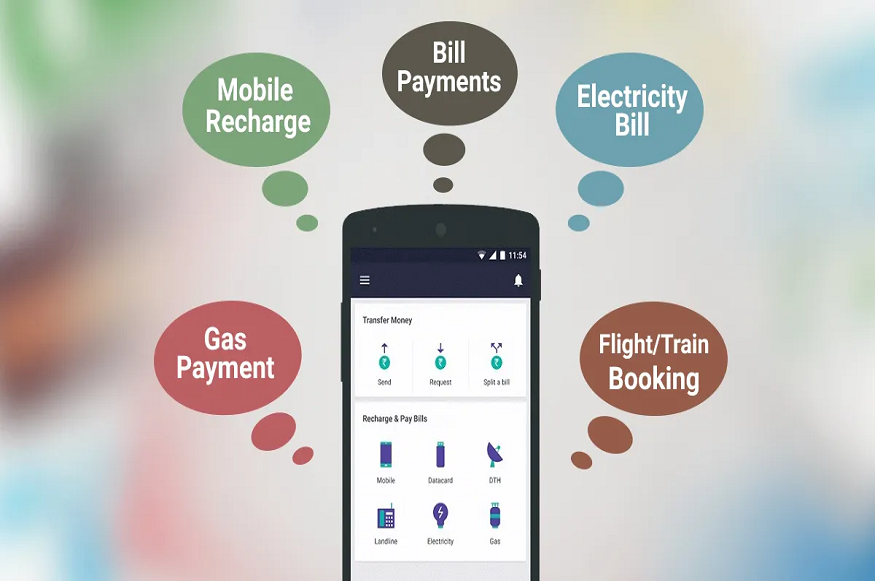

One of the standout features of digital bill payments is their ease of use. With just a few clicks on a mobile app or website, individuals can pay their utility bills, credit card dues, or insurance premiums. This convenience is especially beneficial for those with busy schedules, eliminating the need to allocate time for physical transactions.

Moreover, digital platforms are designed to be user-friendly, often providing step-by-step instructions to guide even the most technologically-challenged individuals. Accessibility is further enhanced by the inclusion of regional languages and simple interfaces to ensure a seamless user experience.

Enhanced Security Features

Security is a critical aspect when it comes to financial transactions. Many people are initially apprehensive about digital payments due to concerns over data breaches and fraud. However, modern digital payment solutions employ robust security measures, including encryption and two-factor authentication, to safeguard user information.

For instance, many platforms offer real-time notifications for each transaction, allowing users to monitor their account activities closely. Such measures not only boost security but also build trust among users, encouraging the adoption of digital bill payments.

Financial Management at Your Fingertips

Digital bill payments provide a comprehensive overview of one’s financial landscape. They enable users to set reminders for due dates, view payment history, and track expenses over time. This level of transparency empowers individuals to make informed financial decisions, ultimately aiding in better money management.

For example, many apps and platforms allow users to categorise their expenses, providing insights into spending habits. By analysing these patterns, individuals can identify areas for potential savings, contributing to a more sustainable financial future.

Real-World Analogy: The Convenience of Online Shopping

To draw a parallel, consider how online shopping has revolutionised the retail industry. Just as e-commerce platforms have made purchasing goods more convenient and efficient, digital bill payments are streamlining the way we handle our household bills. In both cases, the end goal is to make processes more accessible, user-friendly, and efficient.

Economic Impact and Environmental Benefits

Beyond personal convenience, digital bill payments have broader economic implications. They contribute to the formalisation of the economy by bringing more transactions into the digital realm. This transition aids the government in tracking financial activities, ultimately leading to better economic planning and governance.

Moreover, reducing dependency on paper-based billing systems has notable environmental benefits. By opting for digital payments, households can help in decreasing paper consumption, thereby contributing to environmental conservation efforts. This shift not only supports green initiatives but also resonates with the global push towards sustainable living.

Addressing Common Misconceptions

Despite the apparent benefits, some misconceptions persist regarding digital bill payments. A common belief is that these systems are only suitable for tech-savvy individuals. However, with increasing smartphone penetration and user-friendly applications, digital payment solutions are becoming easier to use for people of all ages.

Another concern is the potential for additional charges. While some platforms might apply nominal fees for certain transactions, many offer free services or incentives, such as cashback and discounts, to encourage digital adoption.

Embracing the Future of Household Finance

The move towards digital bill payments is not just a fleeting trend but an integral part of the evolving financial landscape. Embracing these solutions can lead to significant benefits, including saving time, enhancing financial management, and contributing to sustainable living.

Taking Action

For those yet to make the switch, now is the perfect time to explore digital payment options. Begin by researching platforms that cater to your specific needs, whether it’s an all-in-one solution or specialised services for certain bills. Ensure the platform is secure, reliable, and offers comprehensive support.

Furthermore, engaging with online resources, community forums, or even tech workshops can help individuals better understand and utilise these digital tools.

Conclusion

Digital bill payments are an essential tool in simplifying household finances, offering unprecedented convenience, security, and control. As technology continues to evolve, these solutions will only become more integrated into our daily lives, driving us towards a more efficient and sustainable future.

By embracing digital bill payments, households can not only streamline their financial processes but also contribute to the broader goals of economic formalisation and environmental conservation. It’s time to let go of the conventional and step into the future with digital solutions that make life simpler and more manageable.

Leave a Reply

You must be logged in to post a comment.